How to Structure a Finance Pitch Deck That Converts

To win investor confidence, you don’t just need data—you need a clear narrative, solid flow, and visuals that highlight what truly matters. And it all starts with how you structure your presentation.

How to Structure a Finance Pitch Deck That Converts

In the world of fundraising, your first impression often happens through a presentationspecifically, your pitch deck. For businesses seeking funding, especially startups, a well-structured finance pitch deck can open the door to serious investment conversations. But heres the truth: most decks dont convert because they fail to communicate financial insights in a way thats clear, compelling, and credible.

To win investor confidence, you dont just need datayou need a clear narrative, solid flow, and visuals that highlight what truly matters. And it all starts with how you structure your presentation.

Why Structure Matters in a Finance Pitch Deck

When presenting to investors, structure is more than slide orderits a strategic approach to how your message is received. Investors are constantly reviewing pitches, so your goal is to make their job easier by guiding them through your business model and financials with ease.

A disorganized deck creates friction and raises questions. A well-structured one builds trust, demonstrates clarity of thought, and shows that youve done the work. Think of your pitch deck as a storybook, where each slide builds on the last to lead your audience to one conclusion: this business is worth investing in.

Many companies use pitch deck services to help craft this structure, especially when their in-house team lacks experience in design or investor communication.

Key Elements of a High-Converting Finance Pitch Deck

Below are the essential slides every finance pitch deck should include, along with tips on how to structure them for maximum impact.

1.Cover Slide

Start simple. Include:

-

Company name

-

Logo

-

Tagline

-

Contact details

This sets a professional tone and gives your audience context from the first glance.

2.Problem Statement

What real-world problem does your business solve? Use relatable examples or market data to show the pain point your audience can connect with.

Tip: Be specific. A generic problem wont grab attention.

3.Your Solution

Now that the problem is clear, explain your solution.

Highlight what makes it unique and why its better than existing alternatives. Keep it concise, visual, and impactful.

4.Market Opportunity

Show investors that the opportunity is big enough to matter. Use market research and data to define your:

-

Total Addressable Market (TAM)

-

Serviceable Available Market (SAM)

-

Serviceable Obtainable Market (SOM)

This gives them a sense of your potential scale.

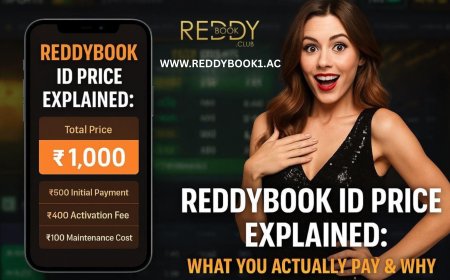

5.Business Model

Explain how you make money. This should include:

-

Revenue streams

-

Pricing model

-

Target customers

-

Sales strategy

Make the business model easy to understand with visuals or flowcharts.

6.Go-to-Market Strategy

Detail your plan for customer acquisition. Who is your audience? How will you reach them? Include:

-

Marketing channels

-

Sales funnel

-

Distribution strategies

This shows that you have a strategy beyond just building a product.

7.Traction and Validation

If you've made any progress, this is the place to show it.

Examples include:

-

Revenue generated

-

User or customer growth

-

Partnerships

-

Testimonials

-

Media coverage

Investors love proof that your business is already gaining momentum.

The Financial Core of the Deck

This is where your pitch truly becomes a finance pitch deck. Its the part that tells investors how your business will growand how their investment will pay off.

8. Financial Projections

Share 35 years of realistic, data-backed projections, including:

-

Revenue

-

Gross margin

-

Operating costs

-

EBITDA

-

Cash flow

-

Break-even point

Use charts and graphs for clarity. Ensure every number has logic behind itinvestors will ask.

9.Unit Economics

Break down your business at a per-unit level. Include:

-

Customer Acquisition Cost (CAC)

-

Lifetime Value (LTV)

-

Customer retention/churn

-

Payback period

This helps investors evaluate your profitability on a granular level.

10.Funding Ask

Clearly state:

-

How much capital youre raising

-

The purpose of the funding

-

Equity offered or terms (if applicable)

This is a slide where clarity and confidence go a long way.

11.Use of Funds

Show how the investment will be used across key areas like:

-

Product development

-

Marketing

-

Operations

-

Hiring

Pie charts or bar graphs are great herethey help visualize the spend.

12.Team Slide

Investors back teams, not just ideas. Introduce your core team and highlight their relevant experience. Keep it short, but credible.

13.Closing & Call to Action

End with a compelling summary of why your business is a great opportunity.

Include a clear call to action: schedule a meeting, follow up, or connect.

Add your contact information once again.

Tips for Creating a Pitch Deck That Converts

? Tell a Story

Dont just present dataconnect the dots. A good pitch tells a story that guides the investor from heres the problem to heres why this investment makes sense.

? Keep Slides Clean

Use short bullet points, high-quality visuals, and one message per slide. Less is more.

? Avoid Jargon

Explain financial terms or tech language where needed. Make your content accessible, even for non-specialists.

? Use Visuals

Charts, graphs, and icons help simplify complex information and keep the viewer engaged.

The Value of Professional Pitch Deck Services

Creating a high-impact pitch deck requires more than just great content. Design, structure, flow, and visual appeal all play a role in winning investor attention. Thats why many founders turn to pitch deck services to professionally structure, design, and polish their presentations.

These services help:

-

Turn raw data into clean visuals

-

Build a logical narrative flow

-

Align your deck with investor expectations

-

Save time and reduce stress during fundraising

When your deck looks as good as your idea, you increase your chances of a successful pitch.

Final Thoughts

Structuring a finance pitch deck that converts isnt about overloading your slides with numbersits about turning those numbers into a story that builds trust. With the right structure, strong visuals, and a confident message, your pitch deck can open doors to the funding and partnerships you need to grow.